Accounting made simple.

Advice that pays off.

Accounting and specialist tax support for SMEs and property clients across Central Scotland.

01 COMPREHENSIVE ACCOUNTING SERVICES

Bookkeeping, tax returns & business advice, in one trusted partnership.

01. Monthly Bookkeeping

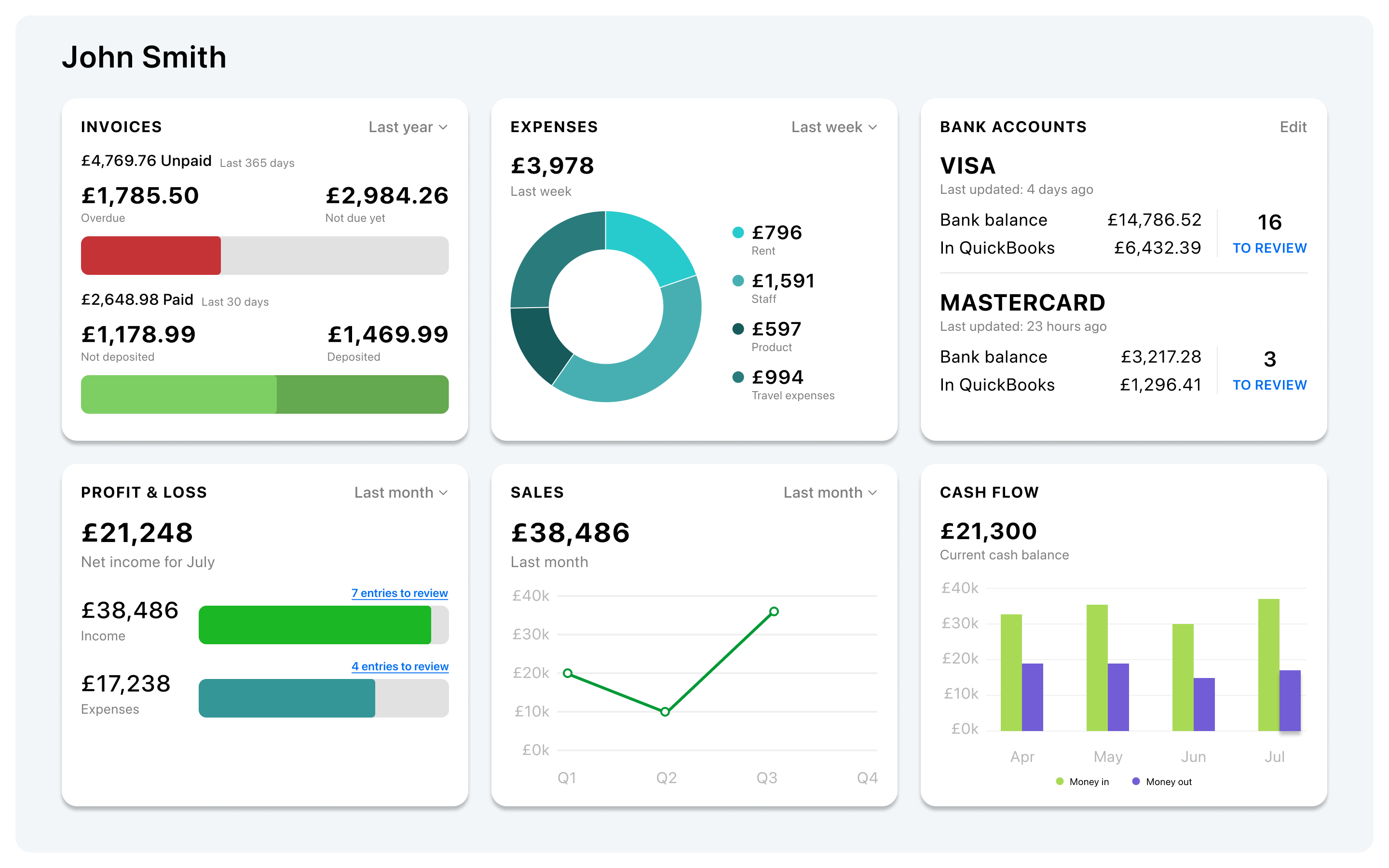

Professional bookkeeping with automated processes. Review, reconcile, and file in one streamlined workflow.

02. Tax Planning

Strategic tax advice with real-time monitoring and planning. Maximise reliefs while staying compliant.

03. Business Advisory

Guidance that goes beyond the numbers — helping you make informed decisions with accurate reporting and insights.

04. VAT Services

Complete VAT management including registration, returns, and Making Tax Digital compliance.

05. Payroll Management

Full payroll processing including PAYE, pension auto-enrolment, and statutory reporting.

06. Management Accounts & Forecasting

Regular management accounts and cashflow forecasting to give you visibility, plan ahead, and stay in control.

02 HOW WE WORK

Three clear steps to a smoother accounting experience.

Initial Consultation

We start with a free consultation to understand your business, goals, and current financial setup.

- Understand your requirements

- Assess your current setup

- Identify opportunities

Our Client Values

We believe great advice should be clear, practical, and easy to act on

Fixed Fees, No Surprises

Clear, transparent pricing with no hidden costs. You know exactly what you'll pay each month.

Plain-English Advice

We explain complex tax matters in simple terms you can understand and act on.

Proactive Support

We don't just react to deadlines - we help you plan ahead and optimise your position.

AIMS Network Backing

Local service with national resources, proven systems, and comprehensive support.

Specialist Property Expertise

Deep understanding of Scottish property tax rules for landlords, developers, and holiday lets.

Technology-Enabled

Modern cloud accounting tools for real-time insights and efficient collaboration.

How It Works

Kickoff

Share your business details and goals.

Setup

We migrate you smoothly and connect your bookkeeping stack.

Run & Optimise

Filings, reviews, and proactive planning all handled.

Our Services

Delivering accurate, timely, and value-driven accounting and tax services for SMEs and property professionals.

Core SME Services

Year-End Accounts & Tax Returns

Accurate preparation and timely filing to keep you compliant.

Bookkeeping & VAT

Maintain clean records and handle all VAT requirements.

Payroll & CIS

Complete payroll services including Construction Industry Scheme.

Management Accounts & Forecasting

Clear insights to help you make informed business decisions.

Specialist Property Services

Tax Planning for Property Investors

Optimise structures for landlords and portfolio owners.

Holiday Let Tax Relief

Maximise allowances and ensure compliance for short-term lets.

Also covering:

- Property development accounting

- Capital gains & LBTT strategies

- Portfolio profitability analysis

All services delivered following AIMS' proven operating methods

View all servicesWhat Our Clients Say

Trusted by SMEs and property professionals across East Central Scotland

"Croft View took the stress out of our annual accounts. Clear explanations, fixed fees, and they always answer our questions promptly."

"As a landlord with multiple properties, their expertise in Scottish tax rules has saved me thousands. Highly recommended."

"They helped structure our holiday let business properly from day one. Professional, proactive, and genuinely care about our success."

Join our satisfied clients across Central Scotland

All testimonials are AIMS-approved and represent genuine client experiences

Get practical accounting solutions that drive growth

Join SMEs and property professionals across East Central Scotland who trust Croft View for clear advice, fixed fees, and proactive support.